According to its acronym (Tax-Free Saving Account), we can quickly understand that any profit we obtain from our money is TAX-FREE.

And yes, it is, but the interesting thing about this type of account is that it can not only be used to save but also to invest.

Inside a TFSA, all your investments grow tax-free because it is a Tax Shelter account and unlike another account called RRSP, which we will talk about on another occasion, if you decide to withdraw the funds it will be tax-free since the money you will contribute has already been taxed.

Who can open a TFSA account?

Any Canadian citizen or resident over the age of 18 who has a valid Social Insurance Number (SIN) is eligible.

How do TFSA contributions work?

You may be saying “too good to be true,” but like any rule, there is an exception. Each year, the federal government announces the maximum annual contribution or (contribution room).

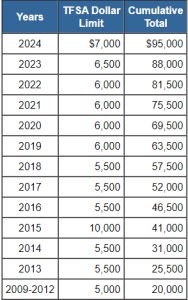

For 2024, it is $7,000. If you stop contributing for one year or do not make the maximum contribution, the unused contribution room is carried forward to the following years.

Therefore, if you turned 18 before 2009, which was the first year that this type of TFSA account became available, your current maximum contribution room is $95,000.

Additionally, if you withdraw money from your TFSA, that exact amount will be available for you to contribute again starting next calendar year.

Therefore, suppose you withdraw $4,000 this year to finance a home renovation; in 2025, you will be able to contribute the maximum announced for that year, plus the $4,000 you withdrew in 2024. If you want more information, visit the official page of the Government of Canada

Can I have multiple TFSA accounts?

There is no limit to the number of accounts you can have, but your total contribution limit remains the same.

Therefore, if your annual contribution (as of 2024) is $7,000, whether you have one or three more at different financial institutions. (The lifetime maximum for those who were 18 or older as of 2009, is $95,000).

The more accounts you have, the more difficult it will be to keep track of them; and there is a penalty if you contribute more than your limit, so it is best to make sure you do not exceed it.

What can I invest in with my TFSA?

You can make the following qualified investments:

Savings accounts: These are the safest vehicles to invest your money since savings accounts are essentially risk-free investments, because they are insured by the CDIC or similar provincial agencies that are units that protect savings.

Guaranteed Investment Certificates (GICs): These are very safe and low-risk investment forms with returns that are normally taxable at your marginal tax rate unless held within a TFSA. They guarantee a rate of return for a fixed period of time, with a term ranging from one year to five years. Non-redeemable GICs pay a higher rate of return in exchange for having your money for the entire term. If you think you might need to access your money before the end of the term, you may choose to hold redeemable/cashable GICs, which allow you to withdraw some or all of your investment at any time, but you will get a lower rate of return.

Stocks and bonds: Investing in the stock market has the potential to pay a considerable return on your investment. However, stocks and bonds are also subject to a high degree of risk. While they can be held within a TFSA, they require a higher level of financial literacy and risk tolerance than other investment options.

Exchange-Traded Funds (ETFs): ETFs are a basket of investments designed to track the performance of a specific market index or sector of the economy, such as the banking or real estate sector. They can also be a mix of different stocks, bonds, commodities, or all of the above. They are bought and sold on an exchange, so you need a brokerage account to trade them individually. ETFs pay a return according to the level of risk you are willing to tolerate and because they are not actively managed, they come with relatively low fees. Since ETFs track the stock market as a whole, they are subject to market volatility and are best used as long-term investment tools, so your investment portfolio has a chance to recover from any losses.

Mutual funds: Similar to ETFs, these popular investment funds are diverse collections of stocks, bonds, and commodities. However, instead of passively following the market or a particular index, mutual funds are actively managed by their financial institution.

Because mutual funds are actively managed, they generally carry higher fees than stocks or passively managed investments like ETFs.

What should I use my TFSA for?

It all depends on the size of your goal and the time frame you want to achieve it. It can be an excellent instrument for saving in the short term with higher returns than a savings account.

On the other hand, if you want to build a long-term investment portfolio but with the flexibility to have your money available at any time, with a good mix of investment instruments, it would be your best option compared to an RRSP account, whose conditions for withdrawing money are very specific and you could have some restrictions.

Finally, I can only tell you to get down to business and evaluate the possibilities of maximizing your money.