An RRSP account is designed to build a savings plan for your retirement. In fact, its acronym in English is Registered Retirement Savings Plan, so it is an account approved and registered by the Government of Canada for retirement.

It was created in 1957 and since then has provided many benefits to all its users. It applies to all citizens and residents of Canada who wish to save and invest. When it comes to taxes, it is one of the most efficient ways to have economic efficiency.

Annual contributions to an RRSP account can be used as a tax deduction. Among its advantages are the reduction of the amount that must be paid on income and that capital gains and dividends are not taxed.

Who can open an RRSP account?

There is no minimum age to open an RRSP. However, you must have earned income from employment and filed a tax return in order to contribute to one. This can be done by you or your guardian.

This is one of the main differences with TFSA accounts, where the age requirement is 18 years old. However, while there is no minimum age, there is a maximum age for the retirement account. Upon reaching the age of 71, RRSPs must be closed by the end of the calendar year.

Options for seniors

Upon reaching the age of 71, those with a retirement fund have the following options:

- Withdraw all of the money.

- Use the funds to purchase an annuity.

- Convert the RRSP to a RRIF, which is a retirement account with the same characteristics as a Tax-Shelter.

How are contributions made to an RRSP?

Every year, Canadian citizens and residents can make a contribution to their RRSP. The amount must be less than the following conditions:

- 18% of the income generated in the previous year.

- The maximum amount specified by the CRA in the current year.

Any unused contribution limit will be carried forward to subsequent years. This means that you will not lose the amount that is not contributed in a particular year.

Can you have multiple RRSP accounts?

The short answer is yes, you can open multiple retirement accounts. However, keep in mind that the contribution limit will remain the same. All contributions from a group or company pension plan must be deducted.

Where can I check my contribution limit?

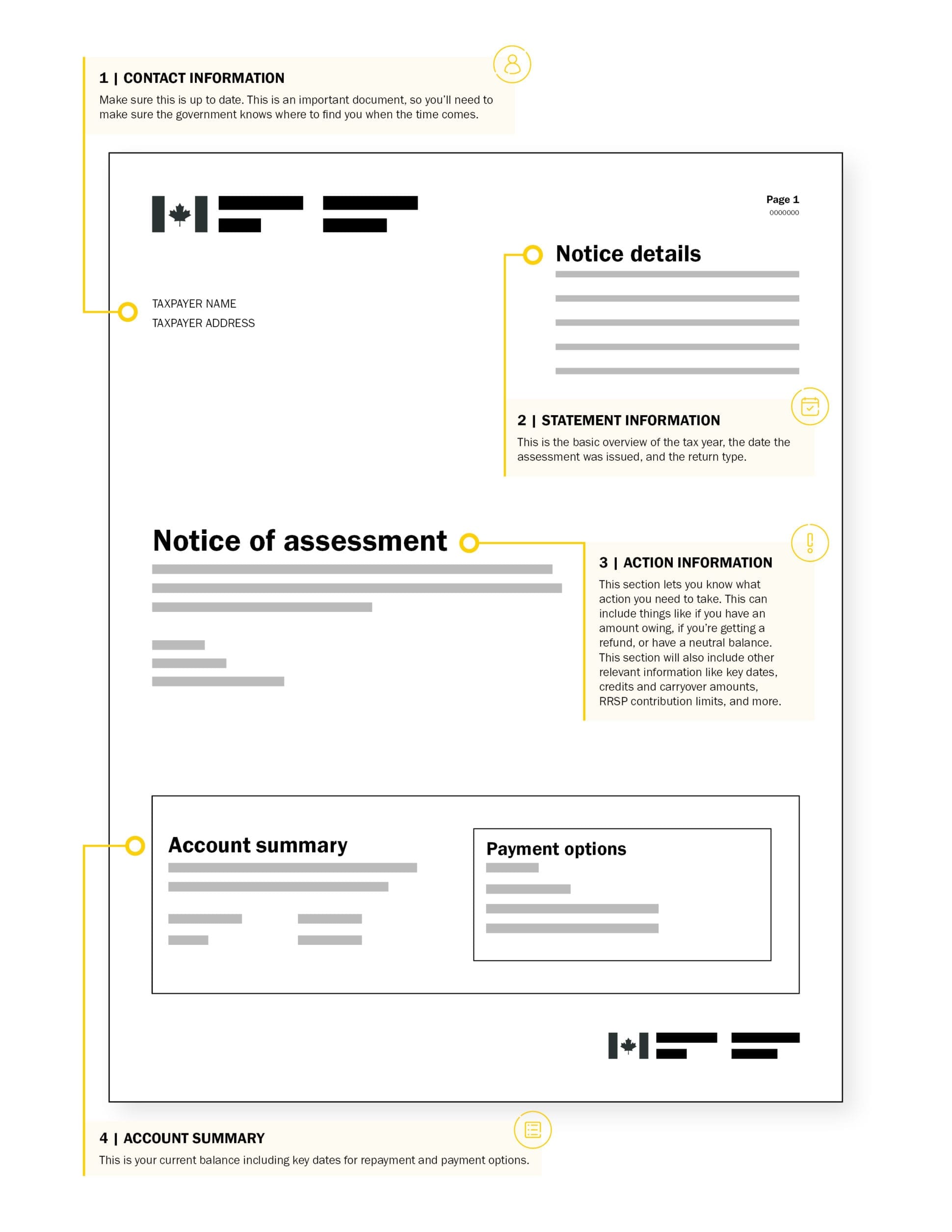

The Canada Revenue Agency (CRA) is an institution that allows Canadian citizens and residents to know their contribution limits. To do this, they issue a Notice of Assessment, which is an assessment of the Tax Return.

You must make contributions during the tax year or in the first 60 days of the following year. In any case, the advantage is that this action serves to qualify for a tax deduction from the previous year.

How can I make withdrawals from my RRSP account?

You should be aware that there are tax consequences if you make a withdrawal before retirement. Therefore, when withdrawing money from the account before time, these will be the taxes to be paid:

- Tax withholding: The financial institution where you have your RRSP will withhold between 10% and 30% of the withdrawal and this will be paid to the government. Likewise, the amount withheld depends on your residency and the amount of the withdrawal.

- Income tax: Money withdrawn from a retirement account is considered taxable income by the CRA. For this reason, the tax bracket depends on your current location. This means that you will probably pay more taxes when you file your return.

In addition, this payment is in addition to the tax withholding that originated when the withdrawal was requested.

Can I make withdrawals without paying taxes?

There are two exceptions where you can withdraw money from an RRSP without being subject to taxes:

- Home Purchase Plan: You have the option of withdrawing up to a total of $25,000 for the purpose of making a down payment on a home. You can do this individually or jointly with your spouse. However, the amount borrowed must be repaid over the next 15 years.

- Lifelong Learning Plan: The loan amount is $20,000, which must be used for new educational training. The maximum withdrawal is $10,000 per year and must be repaid over the next 10 years.

What kind of investments can I have in my RRSP account?

Since it is a registered account, the government allows residents and citizens to invest in buying and selling shares. However, it is essential that the investments qualify in order to avoid tax penalties.

imprescindible que las inversiones califiquen para que nos reciban sanciones fiscales.

Suitable investments

The CRA establishes the basic details on the investments that can be held and are known as “qualified investments”. These include the following:

- Individual stocks, as long as they are traded on a major domestic or foreign stock exchange.

- Government, corporate or savings bonds.

- Mutual or Index Funds.

- Exchange-Traded Funds (ETFs).

- Mortgages and securities backed by them.

- Use of shares in small Canadian businesses.

- Gold and silver.

How to manage investments

RRSP investments can be managed by an advisor. Therefore, you only need to open an online brokerage account and build a portfolio. This is achieved by buying and selling bonds, stocks and other securities.

How to Choose a Good Investment

Before you start investing in your RRSP, determine your goals and risk tolerance. Factors such as age, level of knowledge, and income earned come into play. The younger you are, the easier it will be to take risks and face market volatility.

If you want to obtain additional information, visit the official website of the Government of Canada.

Don’t delay the task of planning your retirement. Instead, do it early so you can make good decisions.