Greetings friends! I know you might be wondering how this whole Credit Score thing works, and I’m also convinced that many of us have received different information from friends and family. This might be confusing, and when we see that our score doesn’t go up, we get frustrated. At MoneyLatam, we want to teach you the best, so read on and you’ll be able to take advantage of it.

What is a Credit Score?

When we talk about Credit Score, we are referring to a three-digit number that ranges from 300 to 900. This is designed to represent your credit risk. That is, the probability that you will pay your obligations on time. Therefore, it is calculated based on the information in your credit report.

What agencies or entities calculate it?

The way your credit score is calculated and the content of your consumer file may vary. It is important to know that the calculation is normally done between the two national credit reporting agencies. (Equifax® and Trans Union of Canada, Inc.). This is because not all creditors report to both agencies and there are different credit scoring models.

First, your score may differ from one agency to another. The reason? While most creditors report to both, you may have an account with a creditor that only reports to one. It also happens when a creditor does not report to either. In addition, each agency has its own scoring algorithm, so that difference is a normal condition. You don’t need to worry about that.

Important factors that influence the calculation

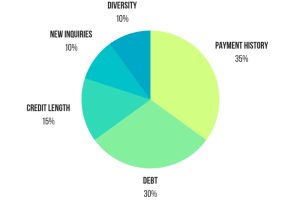

Some of the most important factors that influence the calculation of your Credit Score are the following:

- Payment history

- Credit limit used in proportion to total credit available

- Length of your credit history

- Public records

- Number of inquiries into your Credit Score

Payment History 35%

To have an impeccable record, you need to be very organized with your payments. It is well known that we live in a constant rush and many times we forget to pay some of our bills. My recommendation for you is to organize your payments automatically, so you will be up to date even if you forget to make your payment. You can also set reminders to alert you about important dates. By doing this in this way, you will probably be able to keep up with your payments and pay off your debts.

Usually the payments that have the most weight in the calculation of our Credit score are credit cards. This is almost the first financial instrument that every newcomer should use in their beginnings, mortgage or mortgage credit, car credit and personal lines of credit.

Credit Limit Used in Proportion to Total Available Credit 30%

In view of this, you should analyze how much of the total available credit is being used on your credit cards. You also need to study if you have any other revolving credit line. A revolving credit line is a type of loan that allows you to obtain money from an entity, pay it off, and then reuse the credit line up to its available limit.

The total credit line or credit limit is also included in this factor. This is the maximum amount that could be charged against a particular credit account. Let’s say for example, $2,500 on a credit card, that is, not because you have a credit availability of $10,000 means that it is good to have it fully in use.

Length of Credit History 15%

This section details how long your credit accounts have been in existence. The credit score calculation typically includes both the time the oldest and newest accounts have been open. In general, creditors like to see that you have been able to manage credit accounts properly over a period of time.

Public Records 10%

Those who have a history of bankruptcy, or have had collection problems or other derogatory public records may be considered risky. The presence of these events can have a significant negative impact.

Inquiries 10%

An inquiry means that every time a credit entity accesses your credit file for any reason, the request for information is recorded in the file as an inquiry.

The only inquiries that can affect a credit score are those related to active credit searches (such as applying for a new loan or credit card). These inquiries are known as “hard inquiries” on your credit file.

Please note that inquiries require your consent and some may affect the calculation of your credit score.

On the other hand, there are other types of inquiries called “soft inquiries” which do not affect your score and are in cases where you want to check your score yourself or a creditor wants to review your credit account with them.

How can you check your credit score?

You can do it directly with the two national agencies that I mentioned earlier. However, to issue the report you must pay an amount that can start at $16.95 per month.

But cheer up, not all is lost! There are two companies that provide your Credit Score FOR FREE. The most important thing is that you can check it by doing “soft inquiries” as many times as you need. Therefore, these companies present you with details of your Credit score and make suggestions to improve it. You can also see all your credit accounts and receive notifications.

Reputable national agencies

Therefore, these companies are Borrowell and Creditkarma as well as the two large national agencies that I mentioned earlier. In addition to that, your record score may vary, so I recommend that you sign up for both services through the links described above and thus help me maintain this blog for free with information of interest to you. In the same way, you can download their app to stay informed of any changes in your score.

However, the report issued by these companies is only for your reference. It happens that any credit entity that requires consulting your record will do so with one of the two large companies mentioned at the beginning.

On the other hand, the way these companies make money is by suggesting financial products according to your consumption habits. Once done, if you decide to join any of them, they receive a commission without representing additional charges for you.

Why is it important to check your Credit Score?

It is also extremely important to be reviewing your score. Why? Because there could be significant errors that negatively affect your score. In that case, you can call and fix them on time.

Finally, consider that your Credit Score is not just a reference to apply for a loan or credit card. It can also be very helpful for renting a property and even for job hunting. For this reason, it is important that you take care of it and improve it more and more over time.